This blog will explore 5 reasons why you should review your UK pension.

Lets explore the reasons why you should be reviewing your UK pension.

Charges

Over the last 20 years, the UK pension industry has evolved massively. One of the most noticeable changes during that period has been a significant reduction in charging structures in modern pension schemes. By reviewing your current pension arrangements, you can calculate how much you are currently paying in charges to your pension scheme.

Many people often find after reviewing their pension, that there are significantly cheaper options available on the market. Our advisors can assist you in finding the most suitable option for your needs.

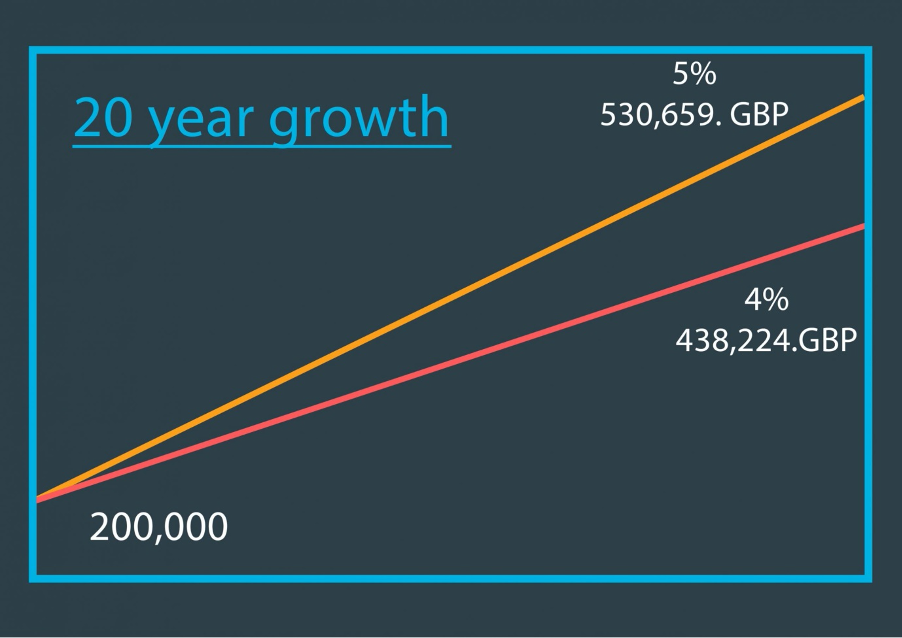

Credence has helped a large number of clients decrease their pension fees by more than 1%. Below, the table illustrates what a saving of 1% can do over 20 years to a pension of £200,000.

Case Study: pension pot of £200,000

4% annualised growth over 20 years will see the pot grow to £438,224.

5% annualised growth over 20 years will see the pot grow to £530,659.

Death Benefits

By reviewing your pension(s) you will be brought up to speed with another important, but often neglected consideration; your pension’s death benefits.

Death benefits can vary massively between different schemes. One of the major drawbacks of holding a defined benefit pension is that when you and your spouse pass away, your pension benefits will cease. If you and your spouse pass away at a young age, the accrued pension savings will be lost.

By reviewing your pension, you will discover there are ways to pass your pension benefits to your beneficiaries when you pass away.

Taxes

When you draw down from your pension – depending on your location – you may be taxed. Credence International specialises in helping clients mitigate tax where possible.

One of the benefits of living in countries such as the UAE is that people can drawdown their entire pension free of income tax.

The Underlying Investments

One of the more significant recent changes within the pension industry has been the improvement in the variety and quality of available investments. Unfortunately, many older schemes still offer a very limited selection of investments to their members.

With defined-benefit pensions, all investment decisions are taken by the scheme. As a result, members have no input over the investment decisions taken.

Defined contribution pensions are somewhat different. Members usually have some control over the investment decisions which are taken; however, members are often restricted in terms of choice.

Credence International help our clients move away from restrictive and expensive pension schemes and into more competitive alternatives. This has been proven to help clients lower their total expense ratio (TER) and improve their investment returns.

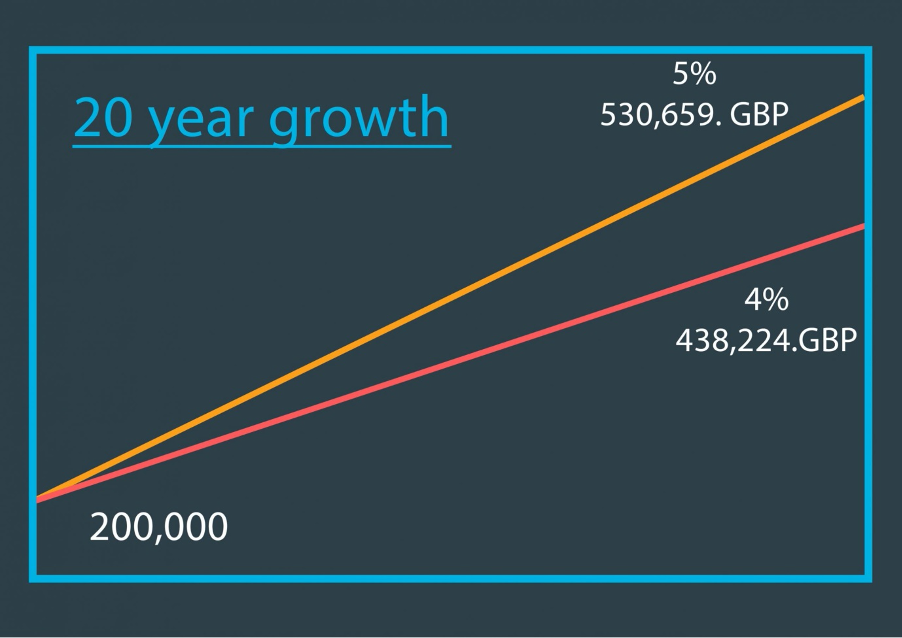

Let’s look at what a 4% difference in fund performance can achieve.

At 4% annualised growth after charges over 20 years the pot will grow to £438,224

At 8% annualised growth after charges over 20 years the pot will grow to £932,191

Cash Equivalent Transfer Values

Members of defined benefit pension schemes may have the option to transfer their drip-fed retirement benefits, for a one-off lump sum. This lump sum is known as a cash-equivalent transfer value and is calculated from year’s worked, final salary and the scheme’s accrual rate.

The CETV offered will fluctuate depending on things such as life expectancy, RPI and CPI, interest rates and gilt yields.

Currently, CETV’s are historically high meaning it is an opportune time to transfer your pension into a SIPP.

People with a defined benefit annual income of £45,000 may well be offered a transfer value of around £1,125,000.

You can also opt for our no obligation service here –> Pension Review Service