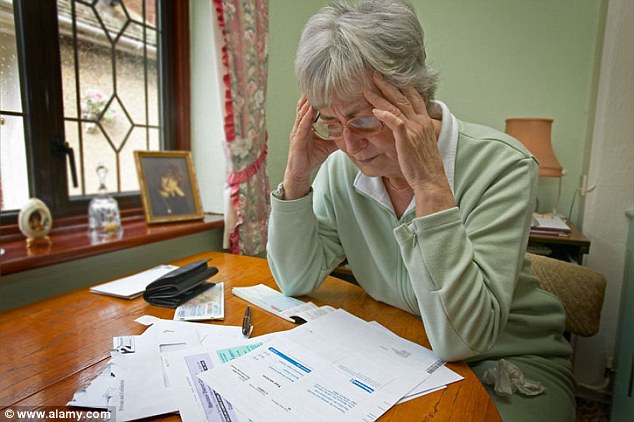

Savers Scared They Will Run Out Of Pension Cash

Only half of retirement savers believe they have enough money to finance a comfortable retirement, according to a new survey.

The other half are concerned their pension pots will run out too quickly, says the research by Citizens Advice.

Six out of 10 retirement savers aged over 50 years old confessed their best hope for retirement was having enough cash to fund a comfortable lifestyle.

They described that lifestyle as having some extra cash to take holidays, travel and to keep active.

Yet one in four are afraid that they will only have enough cash to pay for the basics and are concerned their pensions and savings will run out long before they die.

Valuing retirement savings

The report ‘Approaching Retirement’ looks at retirement saving and reveals that many people have no idea how much money they have to spend when they give up work.

The research also looks at obstacles to saving.

According to the research, only one in five people know the exact value of their retirement savings.

Other key findings showed:

- 18% of savers with several pensions worth less than £30,000 do not understand how to work out the combined total of their savings

- 21% consider they do not have enough savings to make the effort of checking out the value worthwhile

- 15% do not want to think about their retirement

- 18% do not know where to find help with retirement savings or pensions

Obstacles to saving

The report disclosed 1,400 discussed their finances in detail with researchers and three barriers to saving were identified:

Fear – Savers were worried their financial plans would come to nothing because politicians keep changing pension and retirement rules

Multiple income sources – Dealing with several income streams makes determining how much money is available harder

Procrastination –People just had not bothered to start saving

Chief Executive of Citizens Advice Gillian Guy said: “People want a lot from retirement but many will never be able to afford their dreams.

“Their expectations are unrealistic and most don’t even know how much money they will have in retirement.”

She also explained people need to start saving for retirement earlier and to start discussing their pension options when they are younger.

To stay updated with more information. Follow us: