Insights

The Effect of Expected Interest Rate Increases on Defined Benefit Pension Transfer Values

After the Brexit vote in 2016, the Bank of England reduced its benchmark Bank Rate to 0.25%. This was decided upon by the Monetary Policy Committee (MPC) to limit the risk of the recession resulting from the decision to leave the EU. On the 2nd November 2017, we witnessed the first Bank Rate increase in…

Continue readingHow to transfer UK pension to an Australian super

Thinking about moving your UK pension to an Australian Super? Here are some information points you should be considering. Why? Chance to spend retirement in Australia. Tax-free pension transfer. Tax-free paid-out benefits after 60. Flexibility in investments and drawdown. How? In 3 simple steps! Choose a QROPS. Consult a pension transfer service provider to help…

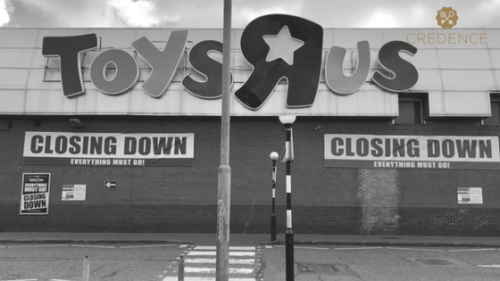

Continue readingToys ‘R’ Us closing down. How is Online Commerce Killing the High Street?

Traditionally, bricks and mortar retail stores have been synonymous with the way we choose to shop. However, as E-Commerce rises in popularity, there is growing uncertainty over what the high street will look like; let’s say in the next ten years or so. The bitter truth is, the future looks bleak for the high street…

Continue readingThe £210bn Two-Thirds Pensions Time Bomb: Worrying Times Ahead for Retirees

The retirement plans of millions of workers in the UK are going into turmoil because of the existing deficits in two-thirds of the pensions schemes. Of the 5,588 pension schemes that the Pension Protection Fund (PPF) monitors, there exists deficits in 3,710 of these schemes. This report by the PPF at the end of 2017,…

Continue readingTrends to Watch in Global Wealth Management in 2018

In 2018, just like it has been in the past years, changes and trends in wealth management will be inevitable. Amongst the trends that wealth managers should prepare themselves for includes changes in regulations, intergenerational changes in property ownership and innovation. Then, there is the impending issue of Common Reporting Standards (CRS) and Markets in…

Continue readingAre You Fully Aware of the Tax Implications on Your UK Pension?

Back in 2015, the government introduced the pension freedoms act. Research by Old Mutual has shown that in the first two months, a staggering £72.8m in tax was generated due to these freedoms. This is equivalent to an annual tax boost of nearly half a billion pounds, significantly higher than expected. It was originally feared…

Continue reading